WE MAKE

PRICING

EASY

Join Premier Investors Club

Don’t Make This Mistake When Selling Your Home

In this highly competitive sellers’ market with countless stories of multiple offers significantly above the listed price of a home, it is easy to have the impression that all it takes to sell a house is a sign in the yard.

The No. 1 mistake sellers make when selling their home is not knowing the real market value of their home prior to listing. Multiple offers and offers significantly above the list price of a home often indicate that a home was listed at a price below the market value of the property. That is to say, a home sold above its list price may still be selling below its actual market value. When this happens frequently, as it has, it creates the impression that everything will sell by just creating a Multiple Listing Service (MLS) advertisement.

This Is What Is Really Happening

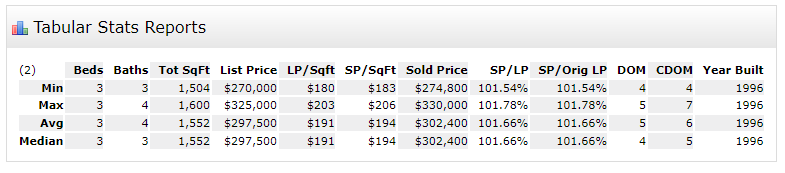

The average time for a home to remain on the market is 10 days, and many homes are selling at or below the list price. Homes that do sell above the listed price are generally sold 1-3% higher than its listed price.

To achieve the highest possible price for a home in today’s market, a seller and their agent must know the real market value of the home, and the agent needs to aggressively market the listing.

Unfortunately, even some real estate agents ignore the facts and get caught up in the perception that anything will sell if they just put it in the MLS. As a result, many agents are doing less to market a home instead of more.

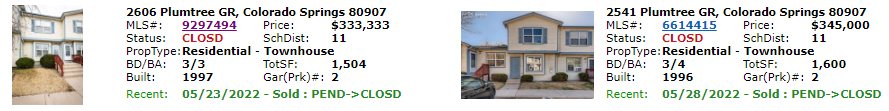

When our property was listed for $345,000, another similar unit in the complex was listed for sale at $310,000.

The pricing analysis for our listing was completed by our broker and appraiser, Mr. Phil McDonald. The property was also appraised for $345,000 by a different appraiser engaged by the buyer’s lender. The property sold at the listed price of $345,000. This is the value of knowing the real market value before listing.

| Similar unit priced below market value | Our listing priced at market value |

The unit listed at $310,000 sold for $333,333. This is a sales price 7.53% above the listed price. It would appear that the seller did well with a sales price above the listed price. However, this sales price of $333,333 is 3.5% below the sales price of our properly priced listing. In this case, did the seller of this unit get a price 7.53% above market value, or did they actually end up selling 3.5% below market value because the correct listing price was not set for the home?

Above Market List Price Can Result in a Below Market Sale Price

If selling a property higher than its list price but below its actual market value results in a loss for the seller, what happens when the seller sets the list price above the market value of a property?

Recalling the general perception of things selling immediately at or above list price, a home priced above market value will suffer. Buyers typically become concerned; questioning if something is wrong with a listing that has been on the market longer than the expected period of time and even more so if the list price is reduced.

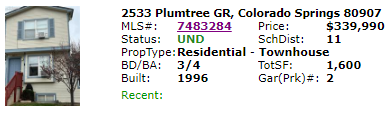

After our property was listed for sale at $345,000, a unit was listed for sale at $348,000. Because our pricing analysis was completed by Mr. Phil McDonald, a broker and appraiser, we were confident that the market value of our home was $345,000.

It appeared that the unit listed at $348,000 was listed above market value. Our property, which sold at the listed price of $345,000, was on the MLS for only two days.

Here is what happened with the property listed for $348,000: The listing price was reduced to $342,900, but the property still did not go under contract. The list price was reduced again to $339,900, and after 16 days the property went under contract. The final list price of $339,900 was 1.5% below our sale price of $345,000. In other words, the original list price of $348,000 was 1% above our list price, but the final list price was 1.5% below our list price. Is it possible that by listing this property 1% above market value, the seller ended up selling 1.5% below market value?

Work With a Broker Who Is Also an Experienced Certified Appraiser

Unfortunately, most agents are not trained extensively in the valuation of a property. As a result, the No. 1 mistake sellers make is not knowing the real market value of their home prior to listing. Getting this part wrong in either direction can cost the seller significantly.

Avoid this No. 1 seller mistake by having Mr. Phil McDonald , our broker who is also a seasoned top tier appraiser, determine the real market value of your home prior to listing.